Randolph Brooks Federal Credit Union - Your Financial Home

Finding a place for your money that feels right, that genuinely supports your daily life and future plans, is, you know, a pretty big deal. It’s not just about where you keep your savings; it’s about having a partner that understands what you need, whether that’s keeping track of your spending, making sure your bills get paid, or planning for bigger things down the road. This is where a credit union like Randolph Brooks Federal Credit Union comes into the picture, offering a way to manage your financial world that feels, in a way, very personal and truly helpful. They work to make your money matters simpler, giving you more time and peace of mind for the things that really matter to you.

For many people, the idea of a financial institution can feel a bit distant or, perhaps, too formal. But Randolph Brooks Federal Credit Union aims to be something different, more like a supportive community rather than just a bank. They’re set up to help you save your money, make your money go further, and even, actually, earn a little extra on what you have. It’s a straightforward approach to money management, one that focuses on your well-being and helps you build a solid foundation for whatever comes next. They want to be a place where your money can, sort of, grow and work for you, every single day.

This means that whether you’re looking to get a better handle on your daily spending, save up for something special, or perhaps need a little help with a bigger purchase, Randolph Brooks Federal Credit Union offers practical tools and friendly support. They make it easy to connect with your accounts, whether you’re at home or out and about, and they have a presence in many communities. It’s all about making your financial life, basically, more accessible and less of a chore, so you can focus on living your life without constant money worries, which is, honestly, a pretty good feeling.

- Mechanic Resurrection Cast

- Albuquerque Airport

- Medical City Plano

- Average Iq In The World

- Mcalisters Deli

Table of Contents

- Your Financial Home with Randolph Brooks Federal Credit Union

- What Makes Randolph Brooks Federal Credit Union Different?

- Staying Connected - Randolph Brooks Federal Credit Union Online

- How Can Randolph Brooks Federal Credit Union Help with Loans?

- Finding Your Way - Randolph Brooks Federal Credit Union Locations

- Is Joining Randolph Brooks Federal Credit Union Easy?

- Building Your Financial Future with Randolph Brooks Federal Credit Union

- Where Does Randolph Brooks Federal Credit Union Stand?

Your Financial Home with Randolph Brooks Federal Credit Union

Thinking about where you keep your money and how you handle it can feel like a really big decision, can't it? For many people, the goal is to find a place that feels like a true financial home, somewhere that offers a sense of stability and helpfulness. Randolph Brooks Federal Credit Union aims to be just that kind of place, a spot where you can, in a way, really settle in with your money matters. They are set up to help you make your money work harder, which means you could potentially save some cash, and also, earn a little extra on your funds. It’s a pretty simple idea, but it makes a big difference in how you feel about your daily finances, honestly.

One of the ways Randolph Brooks Federal Credit Union makes managing your money easier is through their online banking setup. When you want to check on your funds, pay a bill, or just see how things are going, you can get into your account safely and quickly. It's like having your own personal finance hub, right there on your computer or tablet, so you can keep a good eye on everything. This means you can handle your financial tasks from just about anywhere, whenever it suits you, which is, actually, very convenient for busy lives. It truly helps to keep you connected to your money, without much fuss.

Beyond just keeping an eye on things, this online access with Randolph Brooks Federal Credit Union lets you take charge of your financial life in a pretty active way. You can move funds around, send payments for your monthly bills, and even look into services that are, sort of, made just for you. It’s all about putting the ability to manage your money firmly in your hands, so you feel more in control. This level of access and personal touch is a big part of what makes them, you know, a different kind of financial institution, one that puts your needs first, typically.

What Makes Randolph Brooks Federal Credit Union Different?

You might be wondering what really sets Randolph Brooks Federal Credit Union apart from other places where you can keep your money. Well, a core idea behind a credit union is that it's owned by its members, which means the focus is always on helping the people who use its services, rather than, say, outside shareholders. This structure often translates into benefits for you, like potentially better rates on loans or higher earnings on savings accounts. It's a fundamental difference that shapes how they operate and, in some respects, how they serve their community, too.

One of the clear advantages that Randolph Brooks Federal Credit Union brings to the table is the simple idea of helping you save time, save money, and earn money. Think about it: who wouldn't want those things from their financial partner? They work to make processes straightforward so you spend less time on banking chores. They also aim to offer financial solutions that help you keep more of your hard-earned cash in your pocket, whether through lower fees or better loan terms. And, of course, they provide opportunities for your money to, actually, grow while it's with them, which is pretty nice, really.

Another thing that makes Randolph Brooks Federal Credit Union quite special is how accessible membership is. You might think joining a credit union is complicated, but it's often simpler than you imagine. For them, it can start with something as easy as putting a single dollar into a savings account. That small step can be the beginning of building your financial foundation with them, making it very easy to become a part of their community. They also have, apparently, more than five thousand different ways for people to qualify for membership, which means a lot of folks can join, making it, in a way, very inclusive.

Staying Connected - Randolph Brooks Federal Credit Union Online

In our busy lives, being able to take care of things from wherever you are is, honestly, a huge plus. This is especially true when it comes to your money. Randolph Brooks Federal Credit Union understands this, and that’s why they offer ways to stay linked to your accounts, even when you’re not near one of their physical locations. Their online banking system and the Randolph Brooks Federal Credit Union mobile application are your go-to tools for this. They ensure that you can keep a good handle on your funds, pay bills, and access various services, all from your own device, which is pretty convenient, really.

Imagine being able to check your account balance while waiting for your coffee, or sending money to a friend right from your couch. That’s the kind of freedom their online tools give you. You can get into your account safely, which is, of course, very important when dealing with personal financial details. Once you’re in, you’ll find everything laid out in a way that’s easy to understand, allowing you to manage your daily money tasks without much effort. It’s all about making your financial life, sort of, simpler and more in tune with how you live, basically.

One of the standout features that many people appreciate is the direct deposit option from Randolph Brooks Federal Credit Union. This service means you could get your paycheck or federal benefits made available to you up to two days earlier than usual. As soon as your funds are received by the credit union, they work to make that money ready for you to use. This can be a really helpful thing for managing your budget, giving you a little head start on your financial week, which is, you know, a pretty nice perk for anyone, actually. It’s a way they help you get access to your hard-earned money faster, allowing you to plan your spending a little better.

How Can Randolph Brooks Federal Credit Union Help with Loans?

When you're thinking about needing some extra funds, whether it's for a big purchase, to consolidate some bills, or to help build up your credit standing, Randolph Brooks Federal Credit Union has options that might be a good fit. They understand that everyone's financial situation is a little different, and they offer various kinds of loans to help meet those unique needs. It’s about providing you with choices that can, in a way, support your goals, making sure you have access to the money you might need, typically when you need it most, too.

For those looking to improve their credit standing, a credit builder loan from Randolph Brooks Federal Credit Union can be a very helpful tool. This type of loan is specifically designed to help you show a good payment history, which can, over time, make your credit look stronger. The main idea behind it is that the funds from the loan are kept in a special account for safekeeping while you make your scheduled payments. It’s a bit like saving money and building credit at the same time, giving you a tangible way to work towards a better financial future, honestly. You’re essentially showing that you can handle regular payments, which is a key part of having good credit, so.

Then there are personal loans, which Randolph Brooks Federal Credit Union also offers. These loans provide funds that are available right away for your various needs. Maybe you have an unexpected expense, or you want to fund a personal project; a personal loan can give you the money you need without much delay. It’s a flexible option that can help you cover costs when you don’t have enough saved up, or when you simply prefer to keep your savings intact. They aim to make it a straightforward process, so you can get the money you need without a lot of extra steps, which is, actually, pretty important when you're facing an immediate need.

Beyond just getting a loan, Randolph Brooks Federal Credit Union also considers how to help you protect yourself financially, even when things don't go as planned. They offer credit insurance, which can be a real comfort. This kind of insurance is there to help make sure your loan payments are covered if something unexpected happens, like an illness or an injury that keeps you from working. It’s a way to add a layer of security, giving you a bit more peace of mind that your financial commitments can still be met, even during tough times. It’s, basically, about looking out for your well-being and helping you stay on track, which is, you know, a pretty thoughtful thing to offer.

Finding Your Way - Randolph Brooks Federal Credit Union Locations

Even with all the great online tools available, sometimes you just need to visit a physical location, whether it's to speak with someone in person, use an ATM, or handle a more complex transaction. Randolph Brooks Federal Credit Union understands this, and that’s why they have a network of branches and ATMs to serve their members. Finding the one nearest to you is, actually, made quite simple. They have a branch locator tool that helps you pinpoint the most convenient spot, ensuring you can always get the in-person help you might need, which is, honestly, a pretty good thing to have.

When you look up a Randolph Brooks Federal Credit Union branch, you can get a lot of helpful information. This includes the exact street address, the hours they are open, and a list of the services available at that particular spot. You can also find contact details, so you can call ahead if you have specific questions. This level of detail helps you plan your visit, making sure you don't waste time and that you can get what you need done efficiently. It’s all about making your experience, sort of, as smooth as possible, which is, you know, very helpful when you're busy.

For example, if you're ever in Seguin, you might be interested to know that Randolph Brooks Federal Credit Union has a branch located at 1600 E. This kind of specific detail helps people who prefer to visit a branch in person, giving them a clear point of reference. And for those who like to see what others think, you can also look up ratings and reviews for each branch, which can give you a better sense of the kind of service you can expect. This transparency is, in a way, very reassuring, letting you know what to expect before you even step inside, typically.

Is Joining Randolph Brooks Federal Credit Union Easy?

Many people might wonder if becoming a part of a credit union, like Randolph Brooks Federal Credit Union, is a complicated process. The good news is that they've made it quite straightforward to join their financial community. It’s not like there are a lot of hoops to jump through, which is, honestly, a pretty refreshing approach. They want to make it as simple as possible for you to start building your financial foundation with them, and that ease of entry is a big part of their philosophy, too.

The main thing you need to do to get started with Randolph Brooks Federal Credit Union is to put just one dollar into a savings account. That's right, a single dollar can be your first step towards becoming a member and gaining access to all the services they offer. This low entry point makes it very accessible for nearly anyone who wants to become a part of their group. It’s a clear sign that they are focused on helping people get started on a good financial path, without making it feel like a big hurdle to overcome, basically.

Beyond that initial dollar, Randolph Brooks Federal Credit Union has, apparently, more than 5,000 different ways that people can qualify for membership. This means that if you're connected to certain employers, live in a particular area, or are part of specific groups, you might already be eligible. They’ve really worked to open their doors wide, ensuring that a broad range of individuals can find a way to join their financial family. This expansive approach to eligibility truly makes it, sort of, easy for many people to become members and start enjoying the benefits of being with a credit union, you know.

Building Your Financial Future with Randolph Brooks Federal Credit Union

When you think about your financial future, it’s about more than just having money; it’s about having a plan and the right tools to make that plan happen. Randolph Brooks Federal Credit Union aims to provide you with those tools, helping you to not only manage your daily money but also to build something lasting. Whether it’s saving for a big goal, getting a loan for something important, or simply ensuring your money is working for you, they offer various ways to support your journey towards a more secure financial tomorrow. It’s, basically, about empowering you to take control, which is, honestly, a very good feeling.

Part of building that future involves keeping track of any loans you might have. With Randolph Brooks Federal Credit Union, you can sign in to your account to view the current status of your loans or to complete any next steps that might be needed. This transparency and ease of access mean you’re always in the loop about your financial commitments. It helps you stay organized and on track, which is, you know, pretty important when you’re managing different parts of your money life. Knowing where you stand with your loans can bring a lot of peace of mind, allowing you to plan your budget more effectively, too.

The idea of a "financial home" really comes to life when you consider all the different ways Randolph Brooks Federal Credit Union supports its members. From offering early access to your paycheck through direct deposit, which can make a big difference in your weekly budget, to providing credit builder loans that help improve your financial standing, they cover a lot of ground. They also offer personal loans for immediate needs and credit insurance for those unexpected life events, ensuring you have a safety net. It’s a comprehensive approach to money management, one that looks out for your current needs and helps secure your future, in a way.

Where Does Randolph Brooks Federal Credit Union Stand?

It's always good to have a sense of the size and reach of any financial institution you're considering, and Randolph Brooks Federal Credit Union is, actually, a pretty substantial organization. They have their main offices, or their headquarters, located in Live Oak, Texas. This central point helps them manage their wide range of services and support their many members across different areas. Knowing their base of operations can give you a clearer picture of their structure and how they operate, which is, you know, a pretty standard thing to look into.

In terms of their overall financial strength, Randolph Brooks Federal Credit Union holds a significant amount of assets. They have assets that total more than six billion dollars, which is a very considerable sum. This financial backing speaks to their stability and their ability to serve a large number of people. It’s a clear indicator of their standing in the financial world and their capacity to handle the money matters of a vast membership, basically. This kind of financial foundation provides a strong sense of security for anyone who chooses to bank with them, typically.

Speaking of members, Randolph Brooks Federal Credit Union serves a really large community of people. They have more than half a million members, which is, honestly, a very impressive number. This large membership base means they are a trusted financial partner for a lot of individuals and families. These members are served from a wide network of locations, with more than fifty branches spread out to provide convenient access. This extensive reach allows them to help a great many people with their money needs, making them a significant presence in the areas they serve, too.

So, whether you're looking for a place to handle your daily finances, need help building your credit, or are seeking a loan for a specific purpose, Randolph Brooks Federal Credit Union offers a range of services designed to support you. They make it simple to access your accounts online or through their mobile application, and they have many physical locations for when you need to visit in person. Their membership is quite accessible, and they provide various options to help you save, earn, and manage your money effectively. From direct deposit benefits to credit insurance, they aim to be a comprehensive financial partner, supporting your journey towards a more secure financial future.

Randolph Scott - Turner Classic Movies

Рендолф (Массачусетс) — Вікіпедія

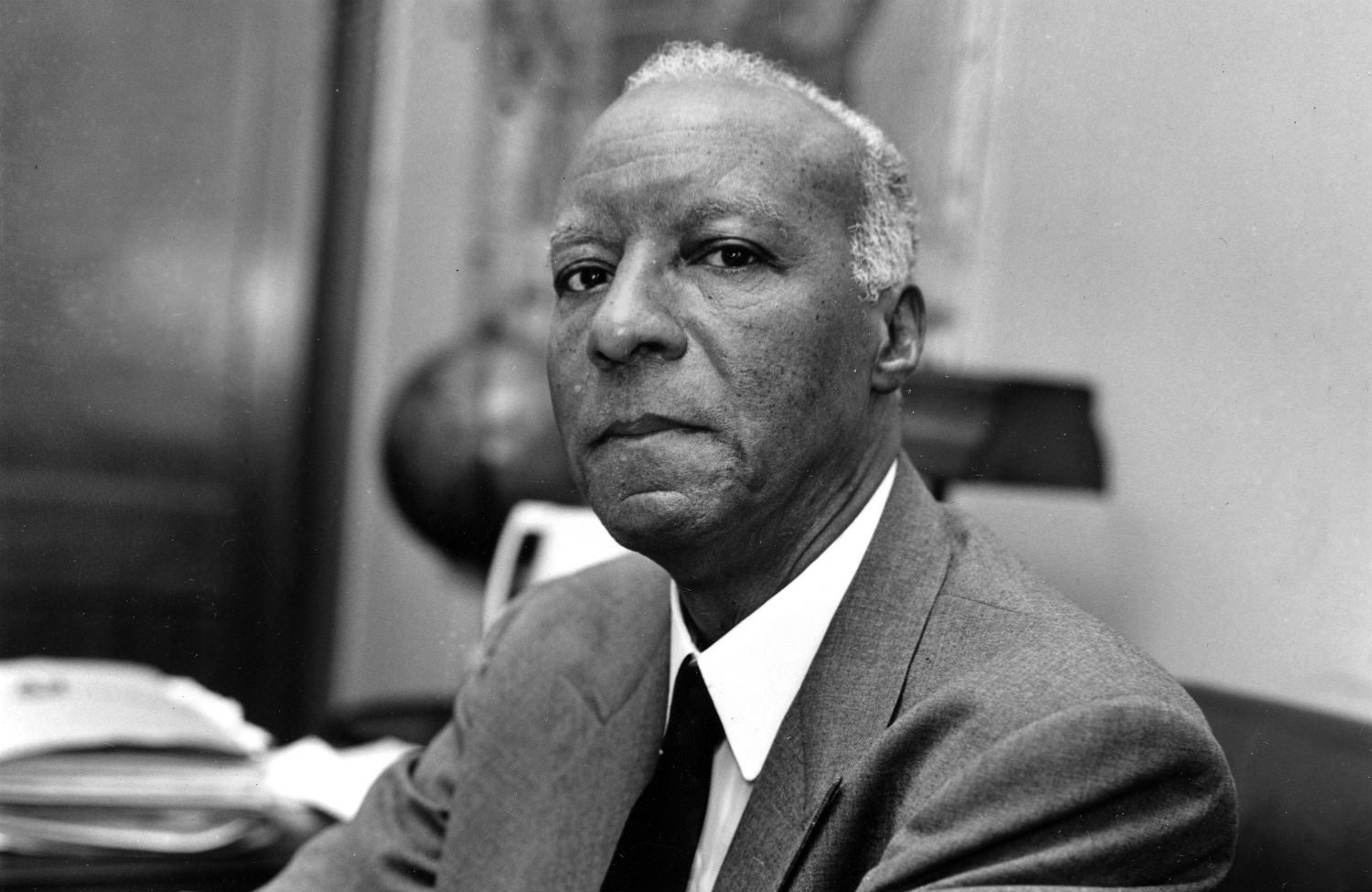

A. Philip Randolph Was Right: ‘We Will Need To Continue Demonstrations